Greetings, today, we’re diving into a topic that might sound a bit dry at first, but bare with me…it’s actually super important and can save you a lot of headaches (and money) down the road. We’re talking about Coordination of Benefits, or COB, and how it works at Asheville Recovery Center. So Grab a seat and something to drink and lets get into it.

What is COB Anyway?

Alright, let’s break it down. Coordination of Benefits is basically a fancy industry way of saying “making sure all your insurance plans play nicely together.” If you have more than one health insurance policy—like if you’re covered by your job and your spouse’s job—COB helps figure out which insurance pays for what. This is so very important for avoiding duplicate payments and ensuring you’re not left holding the bag for expenses your insurance should cover.

Why Should You Care About COB?

Great question! Here’s the deal: when you’re navigating recovery, the last thing you want to stress about is how your bills are getting paid. Understanding COB can help you maximize your benefits and minimize out-of-pocket costs. It ensures that all your claims are processed correctly and that you’re getting the most out of your insurance coverage. Plus, it keeps things clear and organized, which is always a win in our book.

How Does COB Work?

Imagine you’re at a potluck, and you’ve brought two dishes. You don’t want to end up with two bowls of potato salad and no dessert, right? COB works kind of like that potluck coordination, making sure all the different dishes (or insurance policies) complement each other.

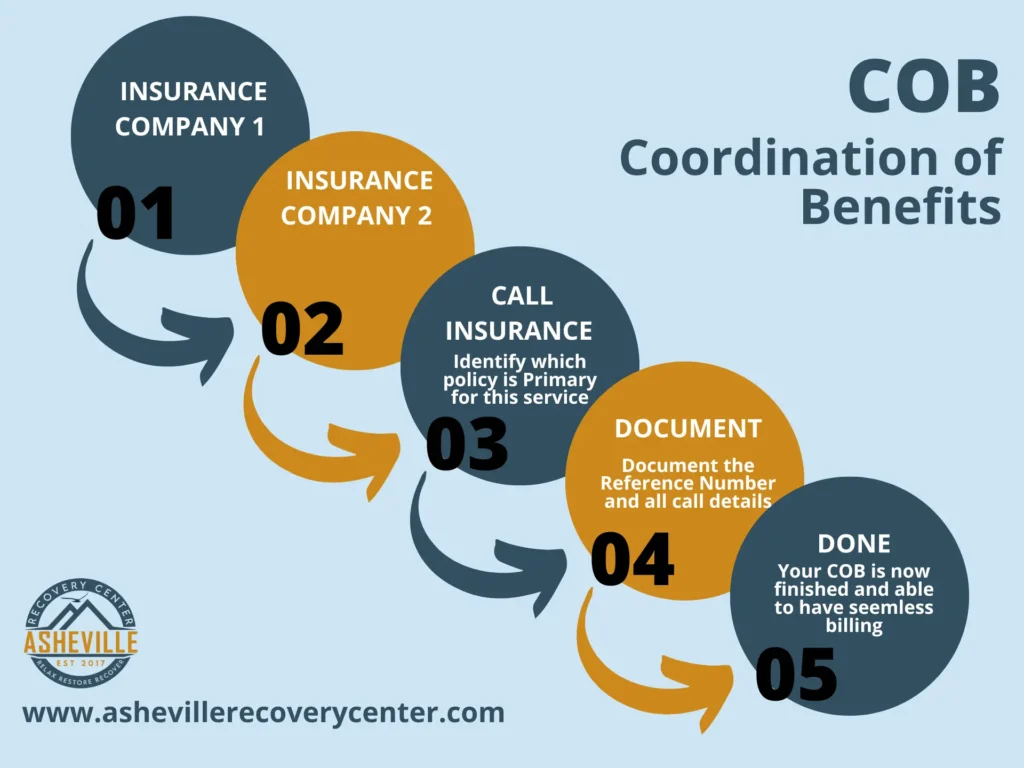

Here’s the step-by-step process:

- Primary and Secondary Payers: Your insurance plans are divided into primary and secondary payers. The primary payer is the one that pays first, covering the bulk of your costs. The secondary payer then kicks in to cover any remaining eligible expenses.

- Filing a Claim: When you receive a service, you or your healthcare provider will file a claim with your primary insurance. Once that’s processed, the secondary insurance gets involved to cover what the primary didn’t.

- Payments and Adjustments: After both insurances have done their thing, you’ll receive an Explanation of Benefits (EOB) statement showing what was paid by each plan and what (if anything) you owe.

COB at Asheville Recovery Center

Here at Asheville Recovery Center, we know that dealing with insurance can be a pain. That’s why our team is dedicated to helping you navigate COB smoothly. We work closely with you and your insurers to ensure everything is coordinated perfectly, so you can focus on what really matters—your recovery.

Whether you have multiple insurance plans or are just trying to figure out how COB applies to your situation, we’ve got your back. Our goal is to make the process as seamless as possible, reducing stress and ensuring you’re not paying more than you should be.

Breaking Down the Jargon

Let’s face it—insurance jargon can be confusing. So, let’s break down some of the terms you might encounter:

- Primary Payer: This is the insurance plan that pays first. Think of it as the main course at your potluck—it covers the bulk of the cost.

- Secondary Payer: This plan kicks in after the primary payer has done its part. It’s like the side dish that complements the main course, covering what’s left.

- Explanation of Benefits (EOB): This is a statement you receive after a claim is processed. It details what was paid by the insurance, what’s left, and what you might owe.

Real-Life Example

Let’s bring this to life with a real-world example. Imagine you’re seeing a therapist as part of your recovery process. You have two insurance plans: one through your job and another through your partner’s job.

- Step One – Visit and Claim: You visit the therapist or facility, and the office files a claim with your primary insurance (your job’s plan).

- Step Two – Primary Payer Steps In: Your primary insurance processes the claim and pays its portion. Let’s say they cover 70% of the cost.

- Step Three – Secondary Payer Kicks In: The claim is then sent to your secondary insurance (your partner’s plan), which covers the remaining 30%.

- Step Four – EOB: You receive an EOB from both insurers detailing what was paid and what (if anything) you owe.

By the end of this process, your therapy session or treatment episode is covered, and you’re left with little to no out-of-pocket cost. It’s like having a perfectly coordinated potluck where every dish is covered!

Common COB Scenarios

Here are a few common scenarios where COB comes into play:

- Dual Coverage: When both you and your spouse have insurance through your respective employers.

- Parent and Child Coverage: When a child is covered by both parents’ insurance plans.

- Medicare and Private Insurance: When someone has Medicare and additional private insurance.

Each of these scenarios involves coordinating benefits to make sure you’re not overpaying (or underpaying which could result in a bill) and that all your claims are handled efficiently.

Tips for Navigating COB

To wrap things up, here are a few tips to help you navigate COB like a pro:

- Keep All Your Info Handy: Make sure you have all your insurance details easily accessible. This includes policy numbers, contact info, and coverage details.

- Communicate with Your Insurers: Don’t be afraid to reach out to your insurance companies for clarification on who pays what.

- Stay Organized: Keep track of all your claims, EOBs, and any communication with your insurers. This will help you spot any discrepancies and resolve issues quickly.

- Ask for Help: If you’re feeling overwhelmed, don’t hesitate to ask for assistance. Our team at Asheville Recovery Center is always here to help you understand and manage your benefits.

COB Myths Debunked

Let’s clear up some common misconceptions about COB:

- Myth 1: You’ll get double the benefits if you have two plans. Fact: COB ensures you get the maximum coverage, but it doesn’t mean double payment for the same service.

- Myth 2: COB is too complicated to deal with. Fact: While it can seem complex, understanding the basics can make it much more manageable.

- Myth 3: Secondary insurance won’t cover anything if the primary insurance covers most of it. Fact: Even small remaining costs can add up, and secondary insurance can help cover these.

Final Thoughts

Coordination of Benefits might not be the most thrilling topic, but understanding it can make a big difference in your recovery journey. At Asheville Recovery Center, we’re here to support you every step of the way, making sure your focus remains on healing and not on financial stress.

If you have any questions or need more info, feel free to reach out to us via Telephone at (828) 237-4582 or fill out a contact form by clicking here and we will call you. We’re here to help you navigate COB and any other insurance challenges you might face.

And there you have it! A comprehensive, easy-to-understand guide to Coordination of Benefits tailored for our friends at Asheville Recovery Center. Feel free to share this with anyone who might benefit from a clearer understanding of how their insurance works together.

Stay well, friends!